Changes to QSBS After OBBBA

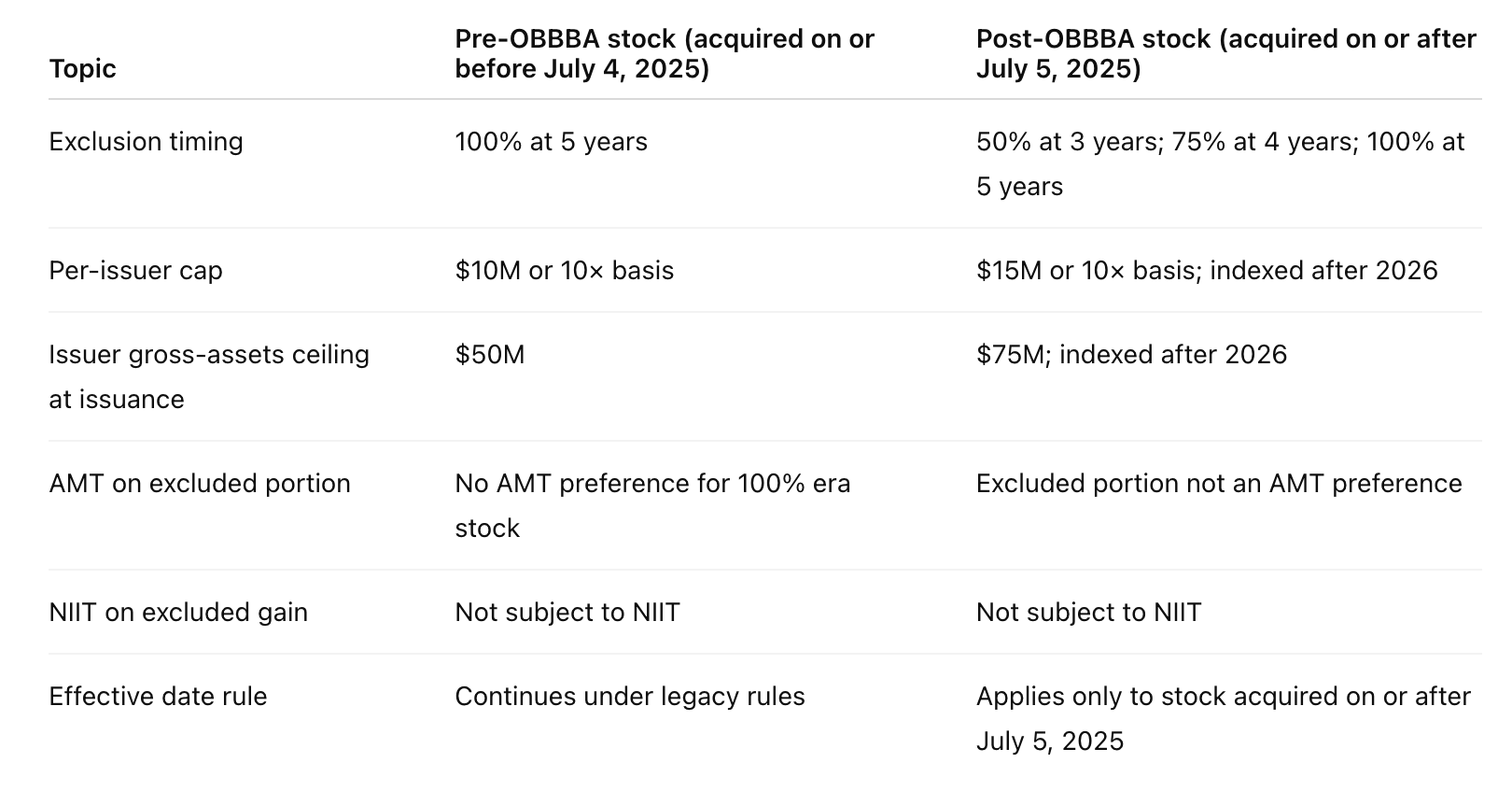

The One Big Beautiful Bill Act, enacted on July 4, 2025, made several forward-looking adjustments to Section 1202. The simplest way to think about the change is by date: stock acquired on or before July 4, 2025 keeps operating under the legacy rules, while stock acquired on or after July 5, 2025 follows the new framework. That split matters because two investors holding the same company’s shares could now be subject to different clocks and limits depending on when they acquired their stock.

For post-OBBBA issuances, Congress introduced a tiered path to the exclusion. After a three-year hold, a sale can exclude 50% of gain. After four years, the exclusion rises to 75%. After five years, it reaches 100%. This sits alongside the legacy approach, where qualifying stock generally needed a full five-year hold to receive the 100% exclusion. In practice, founders and early investors who acquire new shares after July 4, 2025 have a more flexible glidepath to partial relief if a sale happens before the fifth anniversary.

The per-issuer ceiling also shifts for new issuances. Post-OBBBA stock uses a higher cap of $15M or 10× basis, whichever is greater, with indexing scheduled to begin after 2026. Pre-OBBBA stock continues to use the familiar $10M or 10× basis limit. This change primarily helps larger individual outcomes, especially where a single issuer drives most of an investor’s return.

Issuer size at the time of issuance received an adjustment as well. Companies can now have up to $75M of aggregate gross assets at the moment they issue stock and still deliver QSBS to investors, compared with the legacy $50M. That expansion broadens the pool of companies that can qualify going forward, without disturbing the status of older shares that were issued under the previous limit.

There is also cleaner coordination with the alternative minimum tax for the new partial-exclusion tiers. The excluded portion is not treated as an AMT preference item, and the net investment income tax does not apply to properly excluded Section 1202 gain. The taxable remainder, where applicable, is handled under the Section 1202 framework. None of this changes how older, already-issued stock is treated; it simply clarifies the path for new acquisitions.

All of the changes are prospective. Good recordkeeping becomes more important, since many cap tables will contain a blend of pre- and post-OBBBA shares. Investors should be able to show when each block of stock was acquired, the issuer’s gross-asset level at the relevant time, and which cap applies. That documentation will drive both eligibility and the size of the exclusion when a sale occurs.

How a Section 1045 rollover interacts with OBBBA Changes

A common question is whether rolling old QSBS into new QSBS after a sale changes which exclusion schedule you get. The answer is no. A Section 1045 rollover does not reset the exclusion-percentage regime. If your original QSBS was acquired before July 5, 2025 and you sell it, then reinvest the proceeds within 60 days into a new company’s stock, the percentage exclusion that will apply when you eventually sell the replacement shares is determined by the original acquisition date. Your holding period carries over to the replacement shares, which can help you meet the necessary timing, but the applicable exclusion percentage follows the original stock.

It can help to picture a simple example. Suppose you acquired QSBS in 2023, sell it in 2026, and complete a qualifying rollover into a brand-new startup’s stock. When you later sell the replacement shares, the exclusion percentage you are entitled to will be the one tied to your 2023 acquisition, not the schedule introduced for new stock after July 4, 2025. At the same time, the replacement issuer itself is evaluated under the rules that apply to its own issuance. That means its per-issuer cap could be $15M and its gross-assets ceiling could be $75M, because those tests are applied to the replacement company at the time it issued the shares you now hold.

The practical takeaway is straightforward. Use Section 1045 to keep your QSBS benefits intact when you need to sell before the five-year mark, but do not expect a rollover into newly issued stock to move you into the post-OBBBA percentage schedule if your original shares predate July 5, 2025. Keep a clear file that ties each sale and reinvestment together, shows the 60-day window was met, and documents both the original and replacement issuer’s QSBS status.